Belgian firms see 2021 as a transition year, while prospects for 2022 are more encouraging

Brussels, January 2021 – The loss of turnover incurred by Belgian firms as a result of the coronavirus crisis has fallen again slightly in January, to 12 %. This modest improvement is mainly due to the continued recovery of turnover in the non-food retailing, wholesale trade and real estate sectors. The expected improvement on current turnover levels for the whole year of 2021 remains limited, but the prospects for next year have brightened noticeably, which is also reflected in investment plans for 2022. This is the main conclusion to be drawn from the latest ERMG survey among Belgian firms. The number of companies reporting liquidity issues has also fallen back slightly, but that is also explained by the fact that they have taken certain necessary measures themselves. By way of example, since last March, almost one-quarter of self-employed and small businesses have benefited from an extra cash injection from their owners, family or friends. Despite this additional financial support, the self-employed and small firms are still widely confronted with cash-flow problems and a high risk of bankruptcy. Finally, the total job losses expected are down sharply, but the sectoral findings suggest that employment policy will have to help the transition between sectors as much as possible.

A new survey was conducted last week by several federations of enterprises and self-employed people (BECI, NSZ/SNI, UCM, UNIZO, UWE and VOKA). The initiative is coordinated by the NBB and the FEB/VBO. This latest opinion poll is the seventeenth round of a survey conducted since March 2020, with the objective of assessing the impact of the coronavirus crisis and the lockdown restrictions on economic activity in Belgium and on the financial health of Belgian companies. In total, 5 348 companies and self-employed people responded to this week’s survey[1].

Belgian firms report another slight improvement in their turnover in January

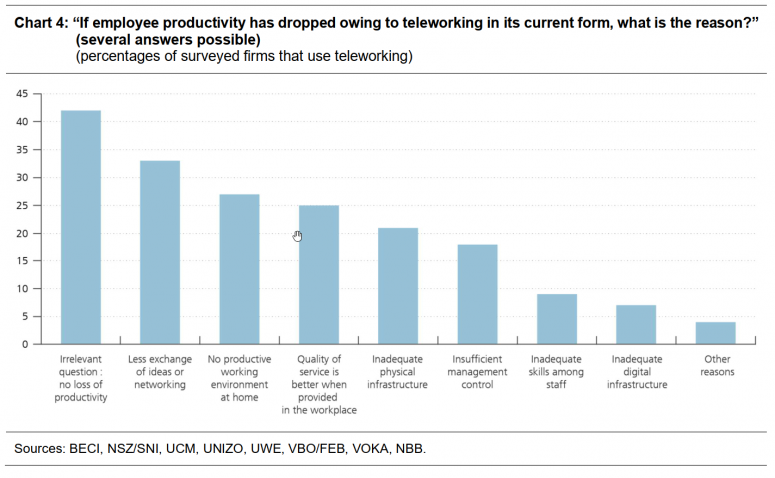

Taking account of company size and sectoral value added, firms questioned this week mentioned a 12.4 % drop in their turnover compared with normal levels. This is an increase of 1 percentage point on the December survey and 5 percentage points from November’s. As in previous surveys, the firms questioned from the Flemish Region and the Walloon Region report a reduction in turnover comparable to the national average, while the impact of the coronavirus crisis on turnover is greater for firms surveyed in the Brussels-Capital Region (-18 %).

The improvement observed in January is mainly due to a recovery of turnover in the non-food retailing, wholesale trade and real estate sectors, namely the sectors of activity that were hit hard by the November lockdown. Loss of turnover compared with normal levels has been around 7 %, which is similar to the results observed in August. The turnover figure for companies in non-food retailing has possible been influenced this week by the seasonal sales and by relatively higher markdowns than normally given at the beginning of the sales period. Given that this effect, just like the pent-up demand effect resulting from the closure of non-essential shops and businesses in November, is only of a temporary nature, the structural improvement could turn out to be a bit weaker and the strong rebound of sales in non-food shops could be partly reversed in the coming weeks. In the other sectors of activity, loss of turnover has remained fairly stable in January compared with December. Losses remain high in the most badly affected sectors, as much as 79, 70 and 24 % respectively in the arts, entertainment and recreation sector, accommodation and food services and in the transport and logistics sector.

[1] The ERMG survey is based on the opinions of the firms taking part, and the results should therefore be interpreted with a degree of caution. The firms questioned vary from one survey to the next, partly because the federations conducting the surveys of their members may not be the same, and partly because firms do not participate systematically in every survey. Although any over-representation in the sample of firms from certain sectors is corrected, it is possible that the firms polled may vary according to other characteristics as time goes by.

Firms are not expecting any substantial recovery of their turnover before 2022, while 2021 is shaping up as a transition year

The expected loss of turnover due to the coronavirus crisis for the year 2021 is 9 %, as in the December survey. So, this is only a very small improvement compared with the current expected loss of turnover, which comes to 12 %. Despite the very rapid development of vaccines against COVID-19, the vaccination campaign will take time. It is therefore becoming increasingly evident that the health situation in Belgium and abroad, as well as the restrictive measures will continue to weigh on corporate turnover for quite some time to come. The recovery of their turnover anticipated for 2022 is more solid, since the loss of turnover is estimated at 4 % for next year. Moreover, this is an upward revision by 2 percentage points on the expectations voiced in the December survey. So, companies believe that 2021 will be a transition year, with only moderate growth of turnover, and that 2022 will be the year when their revenue will pick up at a stronger pace (even though it will still be below the norm for the year as a whole, according to survey respondents).

A similar trend can be observed when it comes to investment plans. The average company surveyed is expecting its investment to be 19 % below the norm in 2021, which is only very slightly better than the drop in investment in 2020 mentioned in the last survey.[2] In the January survey, a question focusing on investment plans for 2022 was asked for the first time and, for that year, a reduction of ‘‘only’’ 11 % on account of the coronavirus crisis was reported. So, that would point to significant growth in investment between 2021 and 2022.

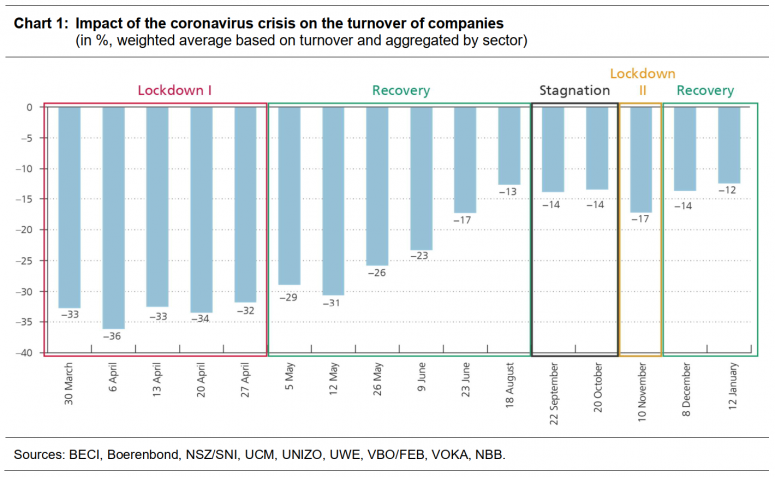

Many self-employed and small firms are still facing cash-flow problems and a high risk of bankruptcy, even though a lot of them have already injected extra capital

This month, a new question was added to the survey about recourse to additional sources of finance since the beginning of the coronavirus crisis. One-third of the firms questioned stated that they had resorted to at least one, event to several additional sources of funding. They were principally capital injections by company bosses, by members of their family or from friends (in the case of 15 % of all respondents), wider recourse to bank loans (12 %) and an extension of deadlines for paying suppliers (8 %). To a lesser extent, intra-group financing (3 %) and shorter payment deadlines given to customers (2 %) were also flagged up, while a capital injection by a public or private investment firm or by another enterprise was hardly mentioned at all.

Recourse to additional sources of finance depends heavily on the sector of activity and company size. The proportion of firms that had benefited from extra capital is much higher in the most badly affected sectors, namely accommodation and food services (62 % of respondents), the arts, entertainment and recreation sector (56 %) and the transport and logistics sector (52 %). The type of funding source also depends considerably on the size of the firm. One in every four self-employed people and one in every five companies employing a maximum of ten people said they had enjoyed a capital contribution from the own funds of the company bosses, their family or friends. On the other hand, wider recourse to bank loans was mentioned by medium-sized enterprises (25 % of medium-sized enterprises questioned), while intra-group financing was important for very large enterprises (18 % of all firms surveyed with more than 1000 employees).

[2] In calculating this average, we do not take account of company size. As large enterprises on average declare a smaller drop in their investment, the overall decline in investment is lower.

Despite wide-scale recourse to additional sources of finance since the beginning of the coronavirus crisis, many firms continue to face liquidity problems. For instance, almost one-third of the firms questioned said that they were facing cash-flow issues, while 20 % of them said they would only be able to meet their current financial commitments for three months at most without having to bank on an additional capital injection or on further borrowing. These figures have nevertheless improved for the second month in a row, after a sharp deterioration had been observed in November. It is worth noting that liquidity problems are a lot more frequent among the self-employed and small businesses with less than ten employees that took part in the survey, with 40 % of them claiming to be confronted with this type of problem.

The perception of a risk of bankruptcy remains virtually unchanged in the majority of sectors from the month of December and is only down marginally at aggregate level. In January, the share of firms questioned that consider bankruptcy is either likely or very likely comes to 9 %, down slightly on the previous survey (10 %). The proportion of firms that said they had already filed for bankruptcy or would do so in the next six months has remained stable, at 6 %. This figure rises to 9 % for the self-employed and small businesses, which means the risk of bankruptcy is also a lot higher for this group.

Labour market prospects are looking brighter for 2021 but are still grim for the worst-hit sectors

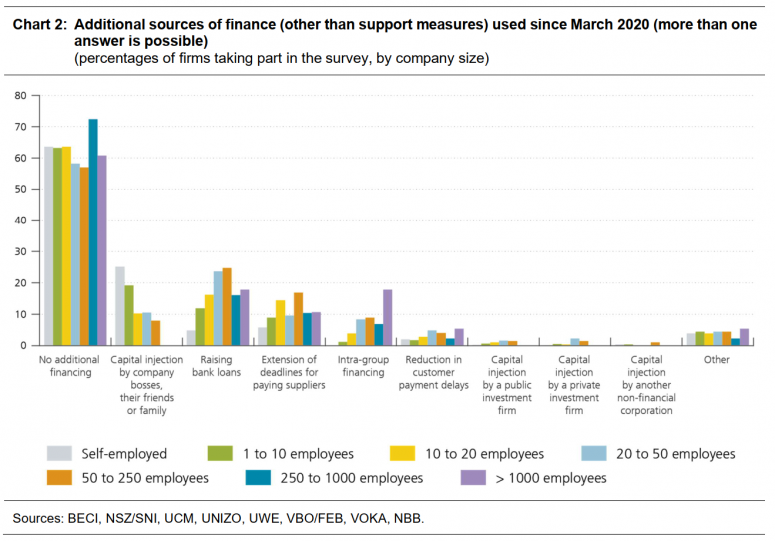

Information about the labour market obtained on the basis of the survey is in line with current developments and above all the slight improvement in the medium-term outlook for turnover. First of all, according to the survey data, recourse to temporary lay-offs has dropped back from 10 % of employment in the private sector in December to 7 % at the moment. The trend is noteworthy in sectors that signalled a recovery of sales turnover in January, namely non-food retailing, wholesale trade and real estate activities.

Then, for 2021, the outlook for employment in the private sector has got brighter, with projected job losses having all but completely disappeared at aggregate level: the decline has dropped back from 23 000 units (or 0.9 % of private employment) in the December survey to 1 800 units (or 0.1 % of private employment) this month. The virtual stability of private sector employment anticipated for 2021 is the result of net job creation expected in sectors like construction, the manufacturing industry, information and communication or support services, which would offset anticipated net job losses in badly affected sectors like accommodation and food services, trade, transport and logistics, or the arts, entertainment and recreation sector. The final impact on employment will therefore also depend on the way in which employment policies are able to facilitate transitions between sectors.

For 2020, companies surveyed are still reporting job losses of 2.0 %. Consequently, the total impact of the coronavirus crisis on the number of employees in the private sector remains strongly negative. On top of that, the monthly results for the survey question dealing with employment expectations are highly volatile and they could potentially reflect composition effects. Besides, these figures are only about salaried staff numbers, while the total impact on employment in the private sector also includes self-employed people who will go bankrupt as a result of the coronavirus crisis.

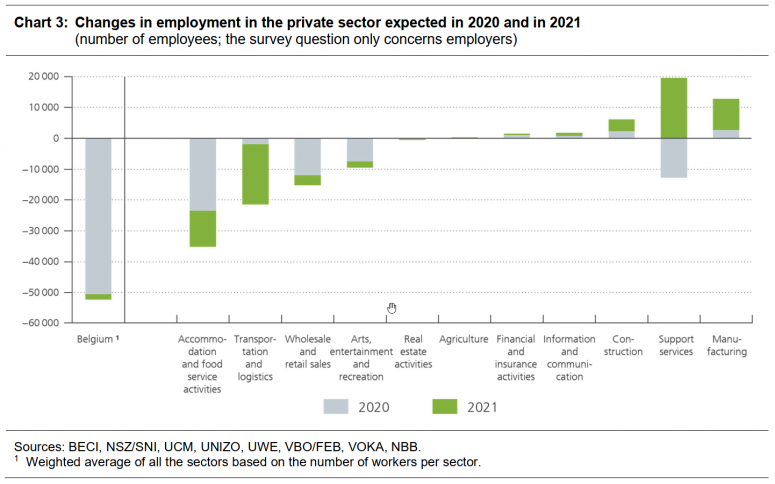

Productivity losses associated with teleworking in its current form mainly stem from the fact that workers are exchanging fewer ideas, reducing networking and are not benefiting from a suitable working environment

Since the beginning of November, working from home has once again been the general rule. In the January survey, the firms questioned said one-third of their employees were working at home full time, which is 3 percentage points higher than the December survey figure. In addition, 12 % of employees work partly at home, a slight drop of 1 percentage point compared to December.

In the last survey, almost half of all company managers questioned said resorting to teleworking in its current form was associated with a loss of employee productivity. This month’s survey enabled firms to be questioned about the reasons for this lower productivity, and almost 60 % of respondents gave at least one. The main reasons cited are the fact that workers are exchanging fewer ideas and are seeing less networking (for example, owing to a lack of spontaneous interactions and the drop in the number of business trips), lack of a suitable working environment at home (because of the home/work balance, for instance) and the poorer quality of service in relation to that provided in the workplace. The other reasons given, such as the lack of physical or digital infrastructure, absence of managerial control and the lack of skills among some staff, are considered as less important.