The coronavirus is still having an impact on the turnover of Belgian firms, but attention is gradually shifting to bottlenecks on the supply side (supply chain, labour market)

The recent easing of restrictions triggered a significant improvement in turnover in some specific branches of activity, such as non-medical contact professions and the arts, entertainment and recreation sector. Nonetheless, there has been hardly any reduction in the overall loss of turnover incurred by the Belgian economy as a result of the coronavirus crisis. Similarly, turnover forecasts still imply (limited) persistent damage while other indicators, such as perception of the bankruptcy risk, have clearly improved this month. These are the findings of the new ERMG survey of Belgian firms conducted at the beginning of last week. Attention is gradually shifting to capacity problems on the supply side. Two-thirds of firms are experiencing difficulty in filling their vacancies, at least for certain profiles, but also are more generally. In addition, there is serious disruption of the supply chain in many branches of activity, such as manufacturing industry and construction, and in many trade segments. These companies have seen a considerable rise in their input costs.

At the beginning of last week, a number of federations representing businesses and the self-employed (BECI, NSZ/SNI, UCM, UNIZO, UWE and VOKA) conducted a new ERMG survey. This initiative is coordinated by the NBB and the FEB/VBO. It was the twenty-first in a series of surveys carried out since March 2020, aiming to assess the impact of the coronavirus crisis and the restrictive measures on economic activity and the financial health of firms. The number of firms taking part was lower than usual (2 274), probably because there was a public holiday during the week of the survey. That slightly increases the margin of error in the results, which should be interpreted with even more caution than usual [1].

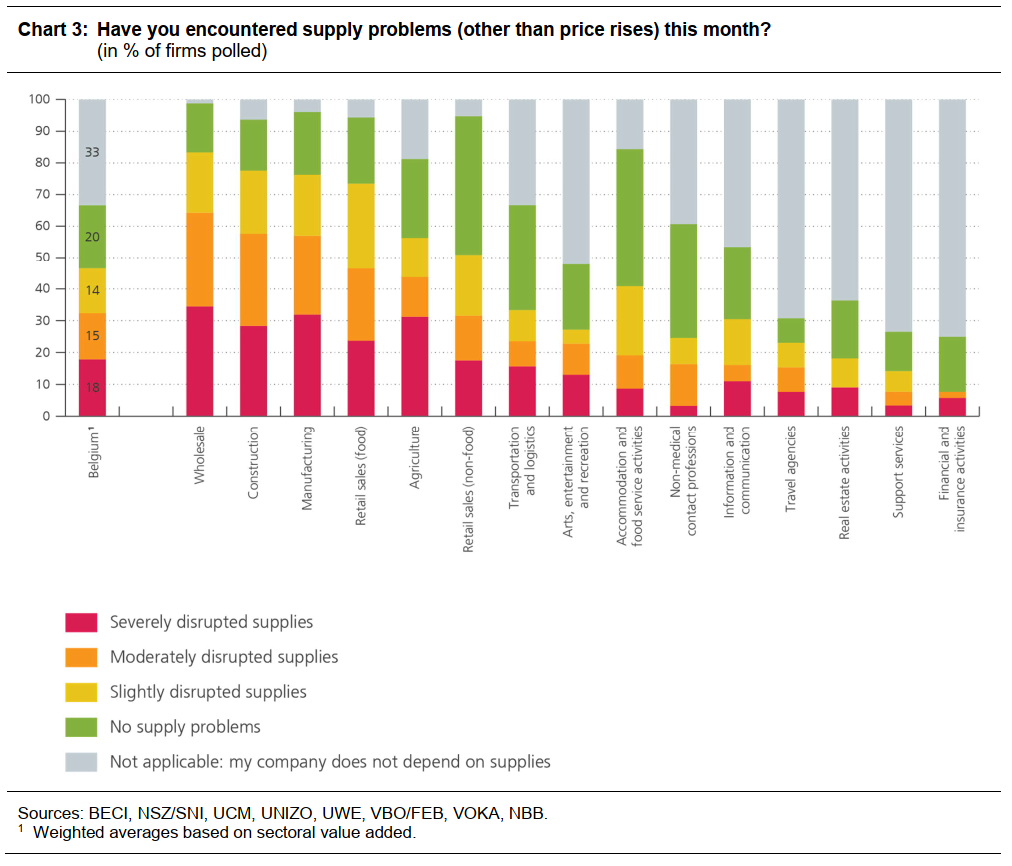

Belgian firms’ current and projected turnover is improving in specific sectors, but at this stage there is virtually no change at macroeconomic level

Taking account of firms’ size and sectoral value added, the firms polled last week stated that their current turnover was down by 10% compared to normal. While the loss of turnover in most branches of activity remained the same overall as in the April survey, the hardest hit branches saw some improvement as a result of the easing of restrictions on 26 April and 8 May (particularly for the non-medical contact professions, retailers and the outdoor terraces of catering establishments). The non-medical contact professions and the arts, entertainment and recreation sector saw the biggest reduction in their turnover loss, down from more than 80% in April to 35% and 53% respectively in May. However, the re-opening of the terraces did not trigger any marked improvement in turnover in the accommodation and food service activities, possibly owing to the bad weather in May. Consequently, the hoped-for catalyst effect on non-food retailers also failed to materialise: their turnover only picked up slightly to 21 % below normal. Finally, travel agencies also experienced some reduction in their turnover loss, down to 80 %.

However, the lack of improvement in turnover compared to April is due partly to the different composition of the sample. That may account for the decline in turnover in logistics and transport and in the financial sector. For example, the hard-hit air passenger transport sector participated to a greater extent in this survey whereas it was under-represented in previous surveys. Without the deterioration in these two branches of activity, the overall loss of turnover would have been 2 percentage points lower than in the April survey. Nevertheless, that is still a meagre reduction.

There is a similar trend in the forecasts of turnover for 2021 and 2022. They have improved significantly in the hardest hit branches of activity, particularly in the arts, entertainment and recreation sector and in accommodation and food service activities. That is due to the improvement in the health situation and the announcement of the “summer plan” for the gradual removal of the restrictions. However, at macroeconomic level these turnover forecasts remain more or less unchanged at 8% and 3% respectively below normal. Without the deterioration in logistics and transport and in the financial sector owing to the said composition effect, there would nevertheless be a slight improvement amounting to 1 percentage point. However, Belgian firms still expect to see minor but persistent coronavirus-related damage next year.

[1] The ERMG survey is based on the opinions of the firms taking part. Comparison of the results over time should therefore be interpreted with a degree of caution, because the firms questioned may vary from one survey to the next. First, it is always possible that the federations conducting the surveys of their members may not be the same. Also, firms do not participate systematically in every survey. Although we correct any over-representation in the sample of firms from certain sectors, it is possible that the firms polled may vary according to other characteristics as time goes by. Finally, it should be noted that the survey results take no account of public administration and defence, education and human health services.

Other indicators such as the bankruptcy risk show a marked improvement

The greater clarity concerning the full reopening of the economy had a favourable impact on the reported bankruptcy risk, as the percentage of firms polled which expect to apply for bankruptcy in the next six months declined from 4.8% in April to 4.0% in May. That was attributable mainly to accommodation and food service activities, where the bankruptcy risk was down sharply from 17% in April to 5% in May.

The degree of concern over the repercussions of the current situation on commercial activities, measured on a scale ranging from 1 (not very concerned) to 10 (very concerned), was also down by 0.4 in May and is now at its lowest level since the start of the crisis (5.6). The level of concern diminished in almost all branches of activity, but especially in the ones which have been hardest hit.

Finally, the labour market indicators also improved in May. The proportion of temporary lay-offs was down from 8% in April to 5% in May, its lowest level since the start of the coronavirus crisis. That percentage dropped particularly steeply in the non-medical contact professions (from 72 % in April to barely 4% in May) and was also down in travel agencies (from 58% to 52 %), accommodation and food service activities (from 59% to 43 %), the arts, entertainment and recreation sector (from 47 % to 20 %) and in non-food retailing (from 16 % to 5 %), although it remained high in these industries. The employment outlook likewise improved in May, and the respondents now expect jobs in the private sector to increase by 22 000 units in 2021. Although the hard-hit industries still expect substantial job losses amounting to around 10 %, the expected marked rise in the number of workers in other branches of activity will more than offset those losses. Nonetheless, the eventual impact on employment will also depend on the ability of the labour market policies to facilitate sectoral transitions.

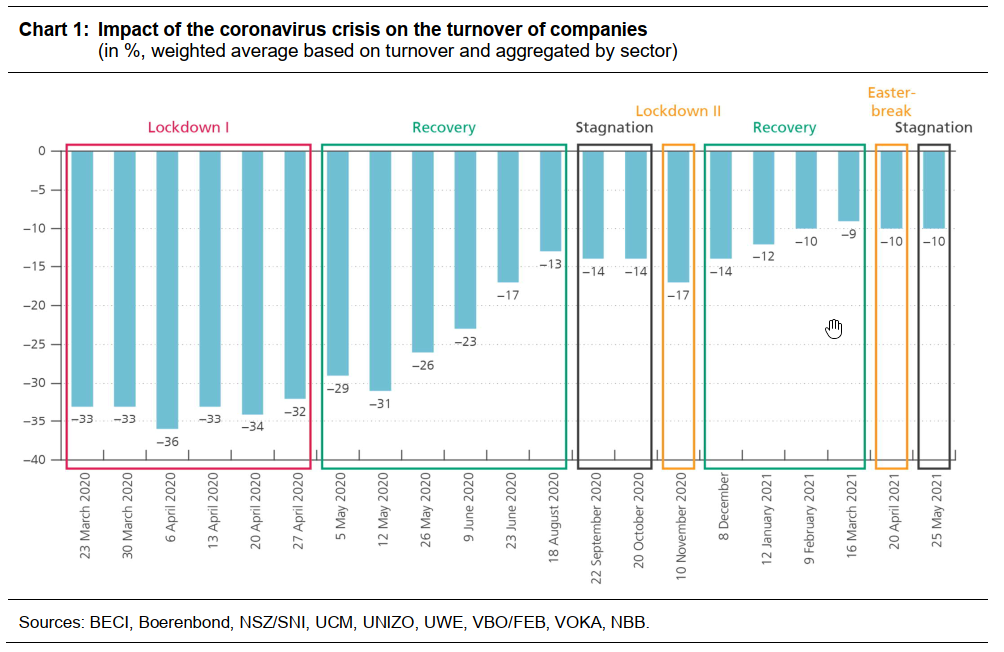

Last year, staff turnover was higher than normal, and many firms report increased difficulty in finding suitable staff

Since February, in the ERMG surveys, supply problems and staff shortages have increasingly been cited as the reason for the decline in turnover. This survey contains more detailed questions on those aspects.

First, the survey asked whether the number of staff leaving of their own accord since March 2020 was higher or lower than normal. While 70 % of respondents reported that staff turnover was normal, and 10% of firms stated that it was lower than normal, almost 20% of firms replied that it was higher than normal. That applied in particular in the arts, entertainment and recreation sector, travel agencies, and accommodation and food service activities, where almost half of firms reported higher than normal staff turnover. That could be good news overall, as it suggests that a significant number of workers in the hardest hit sectors have already found a job in another sector. Such transitions aid the economy’s recovery, and this information also seems to tally with the current relatively favourable labour market statistics. On the other hand, this situation could certainly cause temporary staff shortages if demand picks up in the hardest hit sectors, such as accommodation and food service activities.

The survey also examined the difficulty of finding suitable staff. Among firms wishing to recruit (four out of five respondents, disregarding the self-employed), only one in three stated that it had no more problems than usual in filling vacancies. A third of respondents state that it is harder to recruit certain specific profiles, and the final third states that finding suitable staff is more difficult for all staff categories. Although in principle we cannot rule out the possibility that the specific coronavirus-related conditions are hampering the recruitment process itself, these figures seem to indicate more generally that there is already significant strain on the labour market, even at this early stage in the recovery and despite the said transitions between sectors.

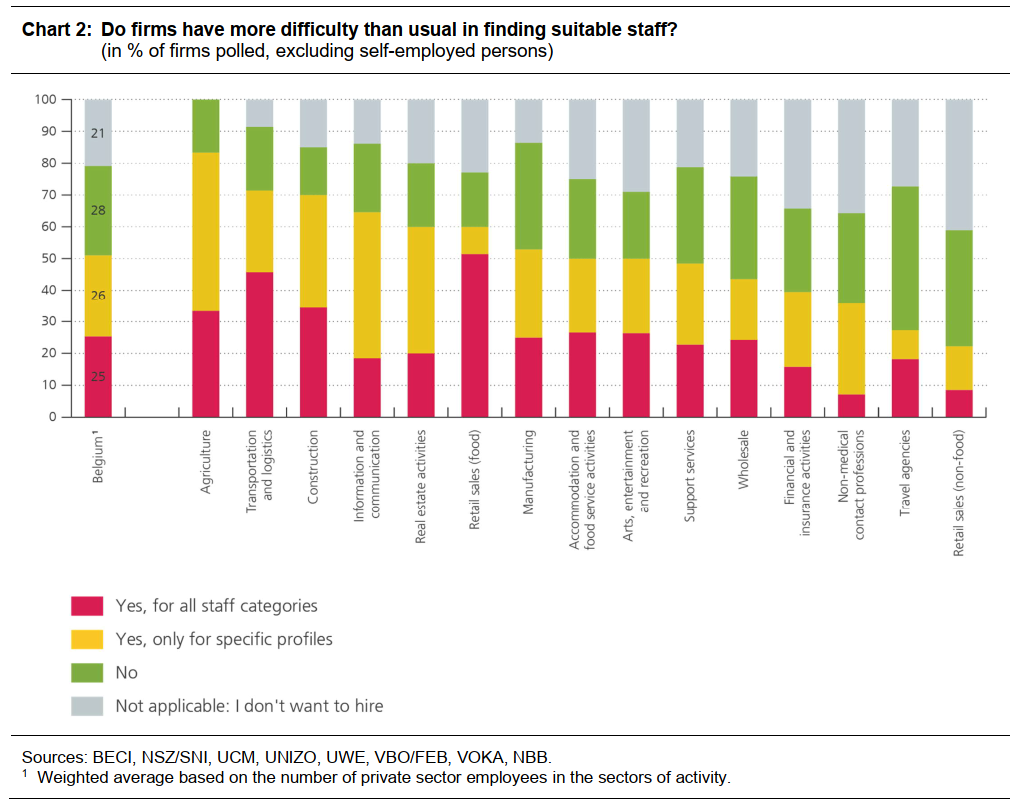

Supply problems are proliferating and the steep increase in input costs will be passed on in selling prices

Another worrying finding on the supply side is that many firms face supply problems. Half of the supply-dependent firms (two-thirds of the firms polled) report moderate or severe disruption in their supplies. Supply problems are particularly widespread in the wholesale trade (64 % of respondents suffer moderate or severe disruption to their supplies), construction (58 %), industry (57 % and even more for some sub-sectors), non-food retailing (46 %) and agriculture (44 %). Conversely, most service sector firms are far less affected since they do not generally depend on supplies. In addition, it is mainly medium-sized firms that are affected, as small firms are less dependent on supplies and large firms report fewer problems of this type.

The main perceived reason for the supply problems is a shortage at the supplier. That factor is cited by almost 90% of the firms facing supply problems (more than one reason can be mentioned in answering this question). Transport is another significant reason for supply problems: it is mentioned by one in three firms encountering supply problems and one in two firms in the wholesale sector.

In addition, input costs (cost of intermediate inputs, commodities, transport, packaging, etc.) are higher than normal for many firms this month. The biggest increase is evident in industry and construction (both 14 %), and in the wholesale trade (+11 %)[2]. Firms also state that, on average, half of the increase in input costs will be passed on in selling prices in the months ahead. This rise in input costs is due largely to supply problems, as that increase is much greater in the case of firms suffering moderate or severe supply disruption (11 % and 19 % respectively) than for those whose supplies have not been disrupted (3 %).

Supply-side problems concerning both staff and inputs are clearly beginning to impede activity. More than one firm in four states that, this month, these problems have caused a temporary loss of turnover, and more than one in ten reported losing customers on that account. Finally, around 15 % of firms state that they have had to dip into their stocks, reducing their stock levels, and 5 % of firms report that they have already received claims for compensation from customers on account of delay in deliveries.

[2] Not all the participating federations included this question on input costs. Consequently, the findings reported in this section only offer a partial picture which is excessively skewed towards smaller firms.