Are interest rates going to drop?

Sharp rate hikes have increased the scope for cuts in the future

We have just witnessed the most aggressive rate hiking cycle in the history of the European Central Bank (ECB). From a historical low of -0.5% in June 2022, the main policy rate was raised to 4% in September 2023, meaning it is now significantly more expensive for households and businesses to borrow money.

Tighter monetary policy was considered necessary to combat inflation, which reached 10.6% in October 2022, a level previously unseen in the euro area. With inflation falling to 2.9% by October 2023, it appears that this tightening has led to a turning point in the battle against rising prices. Indicators measuring more persistent inflation dynamics have also declined. For instance, so-called core inflation – meaning headline inflation minus its most volatile components, i.e. energy and food – also seems to be on a downward trajectory, falling to 4.2% in October after peaking at 5.7% in March.

Current ECB staff projections foresee inflation returning to the 2% target in 2025. With this in mind, the ECB has several options. One option is for the ECB to continue to raise rates in order to accelerate the return of inflation to target. Higher rates could however induce an abrupt slowdown in economic activity. Another option for the ECB is to stop raising rates and to monitor whether inflation developments match projections. This option begs the question of when rates could be cut.

Rate cut expectations are subject to significant uncertainty

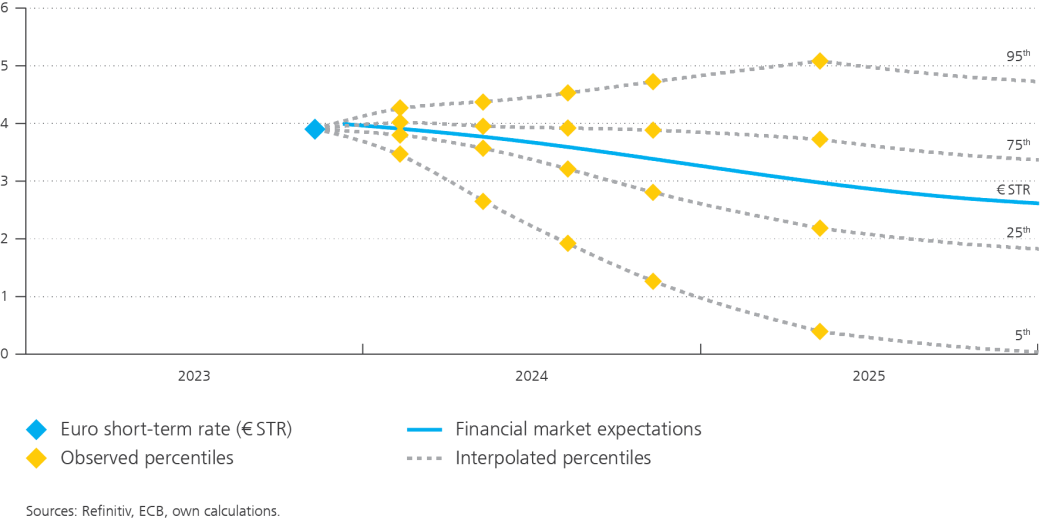

The financial markets seem to think that the ECB is done hiking rates and will start to bring them down sometime next year, as can be seen in Figure 1. The blue diamond reflects the level of the main ECB interest rate, currently set at 4%, while the blue line represents baseline expectations: by the end of 2025, the financial markets expect the main policy rate to fall below 3%. In practice, things are a little more complex than this, as these data also include risk premia, but the general point about market sentiment still stands.

If we look more closely at the distribution of interest rate scenarios anticipated by financial market participants, we see that there is a lot of uncertainty surrounding baseline projections and that market expectations regarding a rate cut are not unequivocal.

As no one knows what the future holds, however, the main ECB interest rate could well depart from these projections. It cannot be excluded that what is thought to be a potential turning point for inflation may in fact not be. In this case, inflation could well stop falling and the ECB could be forced to keep rates higher for an extended period. But the opposite could also occur: inflation could fall more sharply than expected, in which case the ECB would probably have to cut rates more quickly than expected.

If we look more closely at the distribution of interest rate scenarios anticipated by financial market participants, we see that there is a lot of uncertainty surrounding baseline projections and that market expectations regarding a rate cut are not unequivocal. For instance, participants in the 95th percentile expect the main ECB rate to be raised above 5% by the end of 2025. At the other end of the spectrum, the 5th percentile expects the main policy rate to be cut to almost zero.

Figure 1. Financial market interest rate expectations

(%, 10 November 2023)

An inverted yield curve is not all gloom and doom

As short-term rates are currently higher than longer-term ones, the yield curve is said to be inverted, which is somewhat worrying. Empirical findings indeed show that an inverted yield curve is typically followed by a recession a year or two later. For more information on this topic, please see this article.

We can derive a positive message from the inverted yield curve, namely that inflation is believed to be returning to the ECB’s 2% target in a timely manner.

Although this is inherently a tricky question, it could be argued that the situation is different this time. For instance, the inversion of the yield curve could be attributed in part to past ECB monetary policy decisions (in particular, purchases of long-term bonds) which continue to weigh on longer-term rates. What’s more, a recession has yet to materialise, even though the yield curve inverted eight months ago, in March 2023. A recession cannot be excluded, but a soft landing appears more likely according to the ECB’s projections. Growth should however remain weak for some time.

Looking beyond the question of whether a recession will occur, we can derive a positive message from the inverted yield curve, namely that inflation is believed to be returning to the ECB’s 2% target in a timely manner. Indeed, since nominal rates incorporate compensation for inflation, lower rates in the longer term (compared with short-term rates) suggest that inflation will be more limited in the future. In other words, the central bank is expected to have tamed inflation and therefore to be able to cut its main policy rate.

As shown in Figure 2, the financial markets expect a swift return of inflation to the 2% target. We use two measures to determine inflation expectations from financial market instruments. The first indicates the inflation levels expected by markets for the coming twelve months (the orange line in the figure), while the second reveals where they expect inflation to be in one year, two years, etc. (the orange diamonds). Looking at the results, its seems that the markets expect inflation to continue on a downward trend towards the 2% target, which is reassuring and in line with more moderate interest rates in the medium term. To read more about inflation expectations and the uncertainty surrounding them, see this article.

Figure 2. Financial market inflation expectations

(%, 10 November 2023)