When are you planning to retire?

The age at which Belgians are retiring is climbing

Many of us may be wondering about the right age at which to retire. Some of us may even have consulted mypension.be to find out the date at which we’ll be eligible to receive the state pension. According to data from SHARE (the Survey of Health, Ageing and Retirement in Europe), although the legal pension age in Belgium is currently set at 65, the average retirement age is actually 61.

The trend is nevertheless upwards: older workers now plan to retire at around 63. For the economy as a whole, and public finances in particular, extending the working lives of older people is essential. In this blog, we look at the motivation and ability of workers to meet this collective challenge. The situation with which a person is faced at the end of their career can vary on many levels, and from one worker to the next. Unsurprisingly, health and job satisfaction play decisive roles in when we choose to retire.

Several factors are at stake

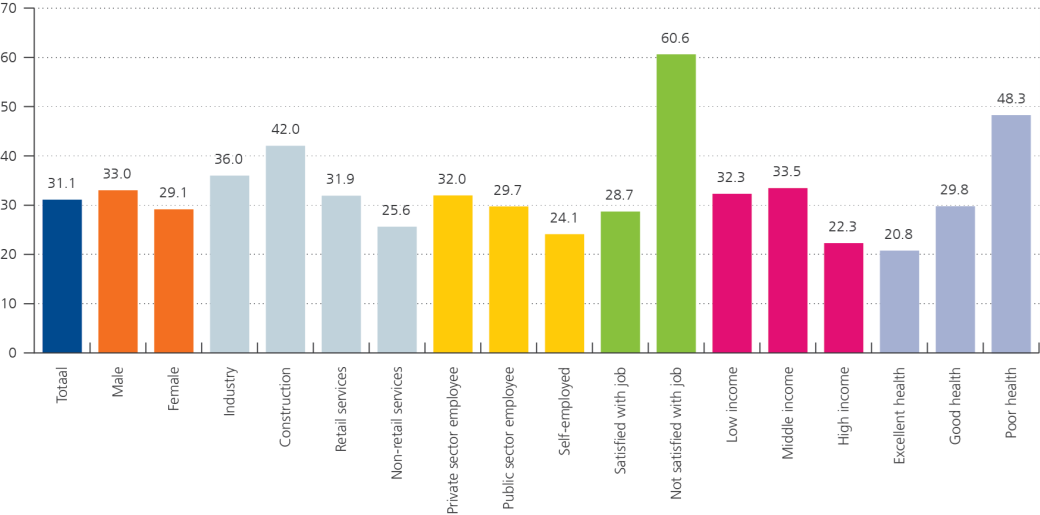

To assess the retirement intentions of older workers in Belgium, we focused on the responses of working people aged 50 to 59 who took part in the SHARE surveys conducted between 2011 and 2020. We analysed their answers to the question, “Thinking about your current job, would you like to retire as soon as possible?” Workers' expectations are, by their very nature, subjective, but they may not be in a position to satisfy these expectations due to a lack of control over certain dimensions. On top of this, although one may wish to retire, financial or family commitments can sometimes mean that it is necessary to continue working. On average, almost one in three workers aged between 50 and 59 would like to retire “as soon as possible”. Who are they and why do they want to do so? Let’s take a quick look at some of the factors involved.

- Gender: until 2009, the statutory retirement age for women was lower than for men. Today, the prerequisites for retirement are the same, but average careers by gender differ in terms of length (often linked to having children), sector of activity, and level of pay. This, combined with women's higher life expectancy, may explain why proportionately fewer want to retire early. 29% of women aged 50 to 59 want to retire early, compared with 33% of men.

- Income level: in theory, a higher income has no obvious effect on retirement age. An executive on a high salary could very well decide to give themself more leisure time by retiring early (substitution effect) or, on the contrary, value an extra year's work (income effect). In practice, the data suggest that higher incomes lead people to want to retire later: only one in five of those on the highest incomes wants to retire early, compared with one in three of those on lower incomes. It is important to note that the type of job a worker does can influence both their salary and their ability to work longer.

- Sector of activity and professional status: some sectors of activity are more physically demanding, on average, or have atypical working hours, both of which could influence one’s ability to stay in work over the longer term. Workers in the construction industry, for example, are more likely to retire early (42%), while those in non-retail services are less likely (26%). Taking account of the arduous nature of work in the pension system is a thorny issue because it is difficult to assess objectively and comprehensively. Notably, the self-employed, who represent only one in nine respondents, often retire later than employees.

- The working environment: job satisfaction, support from one’s superiors, professional recognition, the level of pressure, or the relationship with one’s employer and colleagues are all key factors in staying in work. Only 6% of older workers are dissatisfied at work, but this issue plays a decisive role in decisions over when to retire.

- Health: musculoskeletal issues (such as back or joint problems) or mental health concerns (such as depression or burn-out) can lead to incapacity for work and are more frequent at the end of a career. Among those who consider themselves to be in poor health, one in two would like to retire soon, compared with one in five of those who consider themselves to be in excellent health. However, the majority of respondents (75%) fall into an intermediate category, i.e. they assess their health as good and wish to retire in line with the average.

- Change over time: the expected retirement age increased by one and a half years between 2011 and 2020. This should be seen in the context of an advancing healthy life expectancy and successive reforms to the pension system since 1997, which have made it harder to withdraw early from the labour market. Nevertheless, the proportion of workers wishing to retire as soon as possible is on the rise: 10 percentage points lie between the results from the surveys in 2011 and 2020.

Proportion of positive responses to the question “Would you like to retire as soon as possible?” by category of Belgian worker aged 50-59

(percentage, weighted data)

Among the factors likely to lead to a desire to retire, two clearly stand out: job satisfaction and self-assessed health.

However, these results must be interpreted with caution. On the one hand, variables may be interrelated (between sector of activity and health, for example, or between pay and job satisfaction). On the other hand, there are many aspects that cannot be adequately measured, and what remains unexplained by the variables assessed in the survey remains important. For example, the obsolescence of skills could swing the balance.

Prolonging workers’ careers is a collective objective

In short, retirement is a complex, multifaceted decision, and it is difficult to distinguish between one’s motivation and the ability to prolong one's career. But the picture is not so bleak for the 50-59 age group: two-thirds want to stay in work, 94% say they are satisfied with their jobs, and 90% rate their health as good or excellent. There are various levers that can be used to extend careers, but to maximise the macroeconomic benefits, the effort must be a collective one.

Against a backdrop of a general shortage of skilled labour, it is in companies' interests not only to adapt working hours and working conditions, but also to develop an inclusive human resources policy that values the experience of older employees. This also means adapting the range of training and jobs on offer to suit their specific competences. The benefits that these experienced workers bring to their companies put the additional costs of such policies into perspective.

Inevitably, in the face of this supply, there will also have to be a demand, and an ambition on the part of workers to be involved – insofar as their health allows. As for the public authorities, they could, where appropriate, provide financial support for such initiatives, given that their success would represent an overall benefit for society, which could also be publicised.

For more details, see the article in the Economic Review on this subject: Older workers and retirement decisions in Belgium: mapping insights from survey data | nbb.be